Invoicing software is a powerful tool that can help businesses of all sizes streamline their billing processes, reduce errors, and improve cash flow. By automating invoice generation and tracking, invoicing software allows you to spend less time on administrative tasks and more time focusing on growing your business. In this blog post, we’ll explore the benefits of using invoicing software and how to choose the right solution for your needs.

What is Invoicing Software?

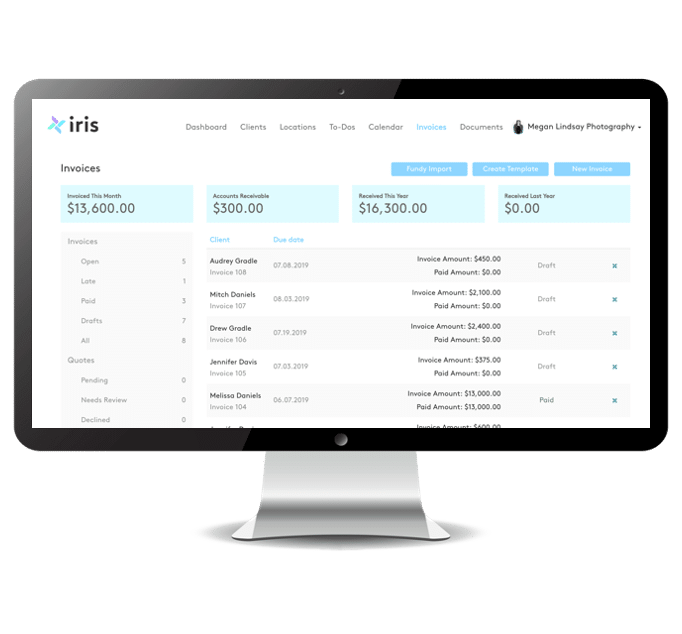

Invoicing software is a tool designed to streamline the billing process by automating invoice creation and management. This will make it easier for businesses to track payments and manage their finances. With invoicing software, users can generate professional-looking invoices in just a few clicks. User can set up automated reminders for unpaid bills and even accept online payments with an invoice software. Whether you’re a sole proprietor or running a large enterprise-level business, investing in an effective invoicing software can help improve your cash flow while reducing the time spent on manual accounting tasks.

The benefits of using invoicing software extend beyond just improving cash flow. In addition to streamlining billing processes, many programs offer advanced reporting features that allow businesses to gain insight into their financial health. These reports provide valuable data. Users can monitor payment trends and outstanding balances which help managers make informed decisions. Business owners can make smarter decisions for future spending or investments. By providing these insights alongside streamlined payment processing capabilities, an effective invoicing solution helps businesses stay competitive while keeping bookkeeping simple and efficient.

Features and Benefits of Invoicing Software

Automated billing and invoicing are two key features of invoicing software that provide immense benefits to businesses. With automated billing, you can easily schedule recurring invoices for your clients and set up automatic payment reminders. Automation helps save time and reduces errors in the process. Customizable invoices with branding is another feature that allows businesses to create professional-looking invoices with their company logo and other customizations. This enhances brand recognition while providing a better experience for customers.

Invoicing software offers automated billing and invoicing, faster payment processing, customizable invoices with branding that enhance brand recognition and ensures timely collection of outstanding balances for improved cash flow management.

Faster payment processing is yet another advantage of using invoicing software over traditional paper-based systems. Using a software streamlines the entire payment process by allowing businesses to accept online payments through various channels such as credit cards, debit cards or bank transfers. The ability to track payments ensures timely collection of outstanding balances which ultimately leads to improved cash flow management for businesses.

Types of Invoicing Software

Basic invoicing software is perfect for small businesses who need a simple and affordable option to manage their invoices. This type of software allows you to create and send invoices, track payments, and manage your billing in one place. However, it may not have the advanced features that larger organizations require.

Enterprise-level invoicing software is more comprehensive than basic invoicing software as it caters to the needs of larger organizations with complex accounting requirements. With this type of software, you can integrate different functions such as accounting and payments into one platform making managing financial data much easier.

Integrated accounting/invoicing software combines both aspects of bookkeeping – creating invoices while also tracking expenses automatically. This system helps reduce errors by automating some day-to-day transactions such as reconciling bank statements or receiving online payments using secure payment gateways.

Some invoicing softwares also integrate with third-party programs, like a photography CRM tool. This allows you to streamline your invoicing process even more through adding invoices to your workflows and online booking calendars. Check out how Iris Works integrates with Square to make invoicing even easier!

Basic Invoicing Software:

* Simple

* Affordable

* Manage Invoices

* Track Payments

* Manage Billing

Enterprise-Level Invoicing Software:

* Comprehensive Accounting Requirements

* Advanced Features

Integrated Accounting/Invoicing Software:

* Automated Transactions

* Reduced Errors

* Secure Payment Gateways

Cloud-based vs. On-premise Invoicing Software

Accessibility from anywhere with internet connection is one of the key benefits of using cloud-based invoicing software. This means that users can access all their invoices and billing information as long as they have an internet connection. Cloud-based invoicing software also offers lower upfront costs which is a significant advantage for small businesses, as it enables them to use the service without investing in expensive hardware.

On-premise invoicing software provides greater control over data security. Companies who handle sensitive payment and accounting information may prefer this option because it allows them to manage their data internally and maintain higher levels of security. However, this option comes with a higher cost due to the need for dedicated hardware and IT support.

Key takeaways:

- Accessibility from anywhere with an internet connectionbenefit of cloud-based invoicing

- Lower upfront costsadvantage of cloud-based invoicing

- Greater control over data securitybenefit on-premise invoicing

How Invoicing Software Helps Improve Cash Flow

Invoicing software can greatly improve cash flow for businesses in several ways. By automating the invoicing and payment processing, businesses can reduce the time it takes to receive payment from clients, leading to a faster turnaround of cash. In addition, invoicing software also reduces errors and disputes that may occur during manual invoice creation, which further streamlines the payment process and improves cash flow management.

Furthermore, invoicing software provides access to real-time financial data that allows businesses to gain more control over their finances by forecasting future revenue streams accurately. This feature also enables automated reminders and follow-ups for unpaid bills with clients who have overlooked or forgotten their financial obligations providing an extra nudge towards timely payments. All these benefits contribute significantly towards better customer relationships since they make communication easier while enhancing transparency between both parties involved – client & business owner alike!

Faster Invoicing and Payment Processing

Customizable invoice templates, automated invoicing, and online payment options are just a few ways invoicing software can speed up your payment processing. With customizable templates, you can create professional-looking invoices in minutes that match your business branding. Automated invoicing allows you to set up recurring invoices for regular customers or schedule future ones ahead of time. Automation helps reduce manual effort and saving time. Offering online payment options means clients can pay faster and easier using their preferred method.

By streamlining the invoicing process with these features, businesses can get paid quicker and improve cash flow management. Invoicing software also reduces errors and disputes. It provides accurate data entry while keeping track of payments coming in or going out of your account. Overall, these benefits help maintain better financial control while improving customer satisfaction through prompt delivery of goods/services without delays caused by slow payments processing times.

Reduced Errors and Disputes

Using an invoicing software can significantly reduce errors and disputes that may arise during the invoicing process. By eliminating manual data entry, which is prone to human error, you can ensure that your invoices are accurate every time. In addition, real-time tracking of invoices and payments allows you to quickly identify any discrepancies or late payments, enabling prompt resolution before they become bigger problems. The built-in dispute resolution tools also provide an effective way to resolve any issues that do occur in a timely manner, ensuring smooth cash flow management for your business.

With invoicing software’s elimination of manual data entry errors coupled with its ability for real-time tracking of invoices and payments as well as built-in dispute resolution tools, businesses can now enjoy more streamlined operations with minimal interruptions in their cash flow management processes. This not only saves time but also reduces costs associated with resolving disputes or correcting errors after the fact. Automated reminders and follow-ups further enhance this experience by ensuring prompt payment processing while offering access to real-time financial data improves decision-making capabilities for businesses who want complete control over their finances at all times – making it easier than ever before to maintain positive customer relationships through efficient invoice management practices!

Improved Cash Flow Forecasting

A good invoicing software offers improved cash flow forecasting, helping you better manage your finances. With the ability to analyze invoice data for trends and insights, you can identify patterns in your customer payments and adjust your strategies accordingly. An invoice platform also provides a visual representation of cash flow projections. This will allow you to easily track where money is coming in and going out.

Furthermore, forecasting features enables predictions based on historical payment patterns. By analyzing previous customer behavior, you can forecast future payment dates with greater accuracy than manual methods. This allows for more informed decisions regarding finances and reduces the risk of unexpected shortfalls or over-budgeting. Using an invoicing software puts control back into your hands by providing comprehensive financial management tools that enable smarter business decisions.

Automated Payment Reminders and Follow-ups

Automated payment reminders and follow-ups are essential features of any invoicing software. With customizable automated reminders, you can ensure that your clients receive timely notifications to make their payments. Additionally, automatic late fees calculation helps streamline the billing process and ensures that all invoices have accurate calculations.

Invoicing software provides multiple follow-up methods like email, text message, etc. This can ensure that your clients never miss a payment deadline. These features help maintain healthy cash flow. You can reduce the number of outstanding payments and improve financial forecasting accuracy. Overall, integrating automated payment reminders and follow-ups into your invoicing software enhances customer experience. Plus you will optimize business workflows for better cash flow management.

Access to Real-time Financial Data

An invoicing software can provide access to real-time financial data through an up-to-date dashboard with key financial metrics. This allows business owners to monitor their finances more efficiently and make informed decisions in a timely manner. The integration with accounting software also ensures that all financial information is synced and updated automatically.

In addition, the real-time tracking of expenses provides a clear overview of where money is being spent, helping businesses identify areas where they can cut costs or optimize spending. With this comprehensive view of their finances, business owners have greater control over their cash flow and are able to make strategic decisions that improve profitability.

Improved Customer Relationships

By using invoicing software, businesses can greatly improve their customer relationships. With faster and more accurate invoicing, customers are able to receive and pay invoices quickly and easily. This results in a smoother payment process, which enhances the level of trust between a business and its clients.

Another way that invoicing software can enhance customer relationships is by providing automated payment reminders and follow-ups. These reminders ensure that payments are made on time, which not only benefits the business but also demonstrates professionalism to customers. Plus, having access to real-time financial data allows businesses to respond promptly to any concerns or issues raised by their clients regarding billing or payments – ultimately strengthening the relationship between both parties.

Choosing the Right Invoicing Software for Your Business

To choose the best invoicing software for your business, consider its features and compatibility with your existing systems. Look for software that allows you to easily create professional invoices, track payments and expenses, and generate reports on your cash flow. Additionally, ensure that the software is secure and can handle a high volume of transactions.

Small businesses may benefit from utilizing simple yet robust invoicing solutions such as Square or Wave, while larger enterprises may require more complex platforms such as QuickBooks Enterprise or Xero. By selecting an invoicing software tailored to your needs, you can optimize your billing process and improve cash flow management for sustained growth.

Considerations when Choosing Invoicing Software

When choosing invoicing software, there are several important considerations to take into account. First and foremost, the ease of use and user-friendliness should be a top priority. A software that is difficult to navigate or understand can lead to mistakes in invoices and delays in payment processing. Integration with other business software tools is also crucial for seamless data transfer and streamlined workflow. Finally, customization options for invoices and templates allow businesses to create professional-looking documents that reflect their brand identity.

- Prioritize ease of use and user-friendliness

- Look for integration with other business software tools

- Consider customization options for invoices and templates

Top Invoicing Software Solutions for Small Businesses and Freelancers

Square is our preferred invoice software provider. Iris integrates easily with Square to make getting paid for your sessions seamless and quick. You’ll be able to collect payments on your invoices sent through Iris using your Square account. This allows you to automate sending invoices, including invoices on your booking calendars, and offer payment schedules. With our integration, you’ll be able to take advantage of the following features:

- ACH Payments: Let your clients pay by ACH bank transfer

- Accept Tips: Square users may choose to incorporate a Tip field on all Iris invoices. The Tip field is optional, and is not automatically included on your invoices.

- Google Pay / Apple Pay: Iris users may enable Apple and Google Pay as a payment option through the Iris + Square integration.

- E-Gift Card Payments: Iris users can now permit their clients to pay for an invoice (or part of an invoice) with a Square eGift Card.

- CashApp: Clients can pay their invoices using CashApp

- AfterPay: AfterPay is a buy now, pay later (or BNPL) option where a customer pays for a purchase over time in installments. As the seller, you are paid upfront! Iris users can offer this option for their clients to pay invoices.

Some other invoice software platforms that are great for small businesses include FreshBooks, Zoho Invoice, and Wave. FreshBooks offers an all-in-one invoicing, time tracking, and project management tool that is perfect for small businesses and freelancers. Zoho Invoice is an affordable solution with advanced features such as recurring invoices and automated workflows. Wave is a free invoicing software with payment processing capabilities making it perfect for startups or freelancers looking to save money on their overhead costs while still having access to essential billing tools.

Top Invoicing Software Solutions for Large Businesses and Enterprises

QuickBooks Online offers a robust accounting software solution that includes invoicing functionality, making it an ideal choice for large businesses and enterprises. With features such as automated billing, customizable invoice templates, and online payment options, QuickBooks Online streamlines the invoicing process and helps improve cash flow.

Xero is a cloud-based solution with multi-currency support and integration options. This makes it an excellent choice for companies that operate across borders or have customers in different countries. Additionally, Xero’s mobile app allows users to create invoices on-the-go, providing even more flexibility.

Oracle NetSuite ERP is a scalable enterprise-level solution with customizable workflows. Its advanced reporting capabilities enable organizations to gain insights into their financial performance at any given time. Moreover, its automation features reduce the risk of errors in invoicing processes while improving efficiency throughout the organization.

Conclusion

In conclusion, implementing invoicing software can significantly improve your cash flow management. By automating and streamlining the invoicing process, you can reduce human errors and delays. These often lead to late payments or missed invoices. Additionally, most invoicing software provides real-time insights into outstanding invoices and payment statuses. Having this information allows you to take proactive measures in collecting payments.

In summary, investing in a reliable invoicing software solution is crucial for any business looking to boost its financial health. With features such as automated reminders and recurring billing options, you can improve cash flow and save time and resources that can be better utilized elsewhere in your business. Don’t let manual invoice processing slow down your growth – switch to an efficient invoicing platform today!

Start Your 14 Day Free Trial

No credit card required!

Recent Comments