Client invoices are a vital step in your photography business and its success. You need to get paid for the work you are doing. Additionally, what the process looks like for your client is important to maintain your reputation and professionalism. Here are some common mistakes that photographers are making when it comes to client invoices.

Top 5 Mistakes Photographers Make with Client Invoices

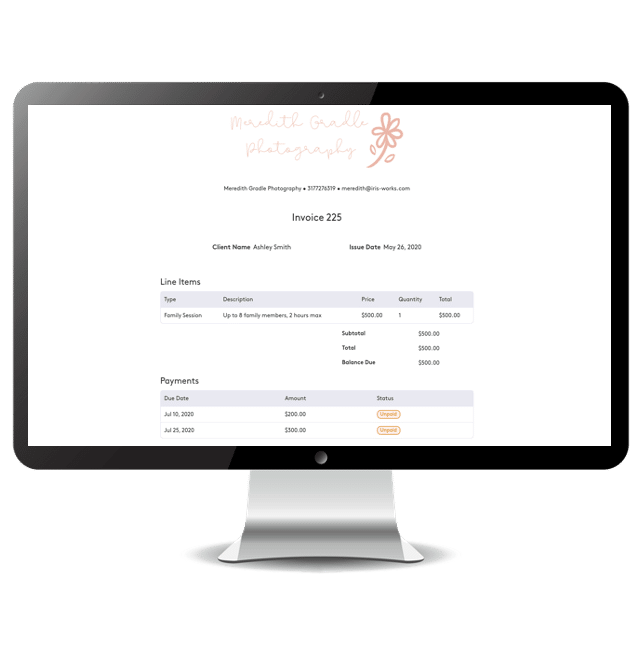

1. Not using an online invoice system

Paper invoices are outdated. It’s time to get rid of those paper invoices that are a nightmare to keep track of and those disorganized spreadsheets. Instead, consider using an online system to send client invoices, as it offers numerous advantages. Firstly, sending client invoices becomes much easier when you have an online system in place to do it. Additionally, online invoicing systems make the process faster, enabling you to promptly send out invoices to your clients. Moreover, such systems greatly assist with bookkeeping, as you’ll have all your invoices organized and tracked in one central location.

2. Not invoicing your clients consistently or timely

Don’t delay invoicing your clients and be consistent. Make sure you are getting those client invoices out timely to ensure you get paid on time. Your clients expect to be billed and make payments on the agreed time frames you laid out in your contracts. Failure to send invoices timely can be seen as unprofessional. Keeping up with invoices can be hard during the busier months, so this another good reason why you would want to get an online invoice system in place. With Iris Works, you can automate invoices and create custom payment schedules for your clients. Your invoices will go out automatically on the dates you need them. Iris Works does the work for you so you can complete other tasks and ensure you still getting paid in the process.

3. Not providing electronic payment methods

While it is fine to accept cash and check payments, you should also be offering electronic payment methods. Only accepting cash or check makes getting paid take longer and isn’t convenient for you or the client. Stop waiting for money to arrive in the mail or scheduling a time to meet with your client to take payments. Electronic payments will make it much easier for your clients to pay their invoices and pay them timely. Iris integrates with Square, Stripe, and Paypal to make it easier for your clients to pay their invoices online. Our preferred payment processor is Square. Square allows you get paid fast – your money shows up in your account as soon as the next business day. They have fair pricing, no contracts or hidden fees, and great customer support.

4. Using apps that aren’t meant for business transactions

Some money apps are not meant to be used for business transactions. For instance, apps like Venmo and CashApp are primarily designed for sending money between friends and people you trust. In fact, Venmo actually states users are not to use the app for purchase of goods and services with personal accounts and they will review these transactions. Consequently, using Venmo for business purposes can lead to complications, including the possibility of not receiving your money. Moreover, it’s important to note that Venmo lacks any sort of protection program specifically designed for these types of transactions. As a result, relying on Venmo for receiving payments or asking clients to pay via Venmo can introduce a level of risk into the process.

5. Not folllowing up on past due invoices

Sometimes a client invoice will go past due. However, don’t be afraid to follow up with your clients on invoices that haven’t been paid timely. It is crucial to have payment terms in place in your contracts, and more importantly, these terms should be followed. If you are too lenient, your clients will continue to get away with late payments, which in turn opens the door for them to try pushing other boundaries.

What are some mistakes you had to learn from with client invoices?

Ready to make the switch to online invoicing and get paid faster?

Sign up for your free 14-day trial with Iris!

Recent Comments