Using Quickbooks for your Photography Business

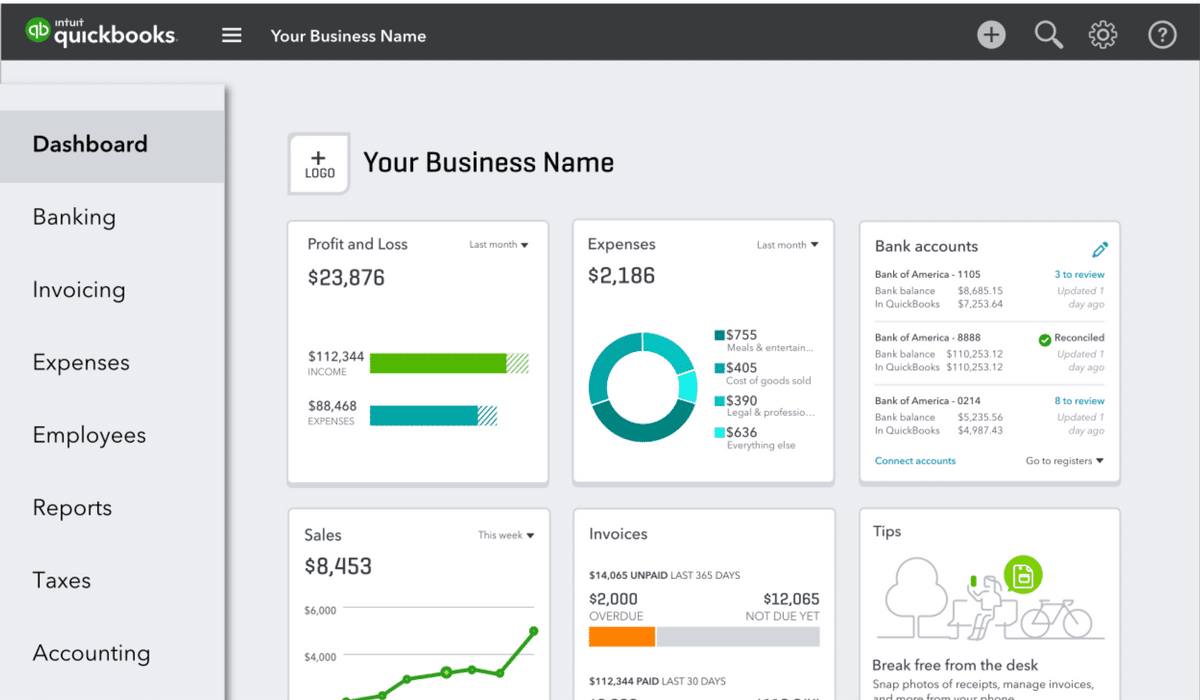

Tax season can be a daunting time for photographers and business owners alike. Many of us have experienced the last-minute scramble and subsequent regrets due to unorganized finances. However, there is a game-changing solution that can save your photography business from unnecessary stress and headaches. QuickBooks Online offers a range of features and benefits tailored specifically to the needs of small businesses. In this blog post, we will explore three key ways in which QuickBooks Online can revolutionize your photography business, helping you stay organized, track your finances, and simplify tax season. Did you know that Iris integrates with Quickbooks too?

Using Quickbooks

Here are 3 ways using Quickbooks Online will save your photography business.

- Automated Bank Account Sync:

- One of the most significant advantages of QuickBooks Online is its ability to sync seamlessly with your bank account. For less than $10 per month, you can automate the process of downloading and categorizing your transactions. This feature eliminates the tedious task of manually inputting financial data, saving you valuable time and reducing administrative work. With a few clicks, you can effortlessly reconcile your accounts, ensuring accuracy and efficiency in your bookkeeping.

- Company Snapshot Report:

- Keeping a close eye on your business’s financial performance is crucial for growth and success. QuickBooks Online offers a Company Snapshot report that provides a comprehensive overview of your income versus expenses year over year. This at-a-glance view enables you to quickly assess the health of your business, identify trends, and evaluate your spending habits. Having a clear understanding of your financial position empowers you to make informed decisions and work towards achieving profitability.

- Secure Data Backup and Support:

- The thought of losing critical financial data due to a computer crash can be terrifying. QuickBooks Online alleviates this worry by automatically backing up all your data with bank-level security. You can have peace of mind knowing that your bookkeeping files are safe and protected. Additionally, QuickBooks Online provides free support to help you navigate any challenges or questions that may arise. Their expert assistance ensures that you can maximize the benefits of the software and overcome any obstacles effortlessly.

Conclusion

When it comes to managing your photography business’s finances, QuickBooks Online is an invaluable tool that streamlines operations and simplifies tax season. The ability to sync your bank account, automate transaction categorization, and view insightful reports saves you time and effort, allowing you to focus on your craft. Furthermore, the secure data backup feature and access to expert support offer peace of mind and ensure the safety of your financial records. Investing in QuickBooks Online is a worthwhile decision that enables you to stay organized, make informed financial decisions, and navigate tax season with ease. Embrace efficiency, embrace QuickBooks Online, and experience the transformative benefits it brings to your photography business.